An Alternate View To The Change In IP Rider Rules

20 Apr 2021

On 8th March, the new requirement to include a co-payment portion in integrated shield plan (IP) riders kicked in. Following rising concerns about escalating healthcare costs, this concept of coinsurance was announced by the Minister of Health in the parliament. While most people are “complaining” about the change, we think otherwise. Here’s our alternate view about the new IP rule that the government has mandated.

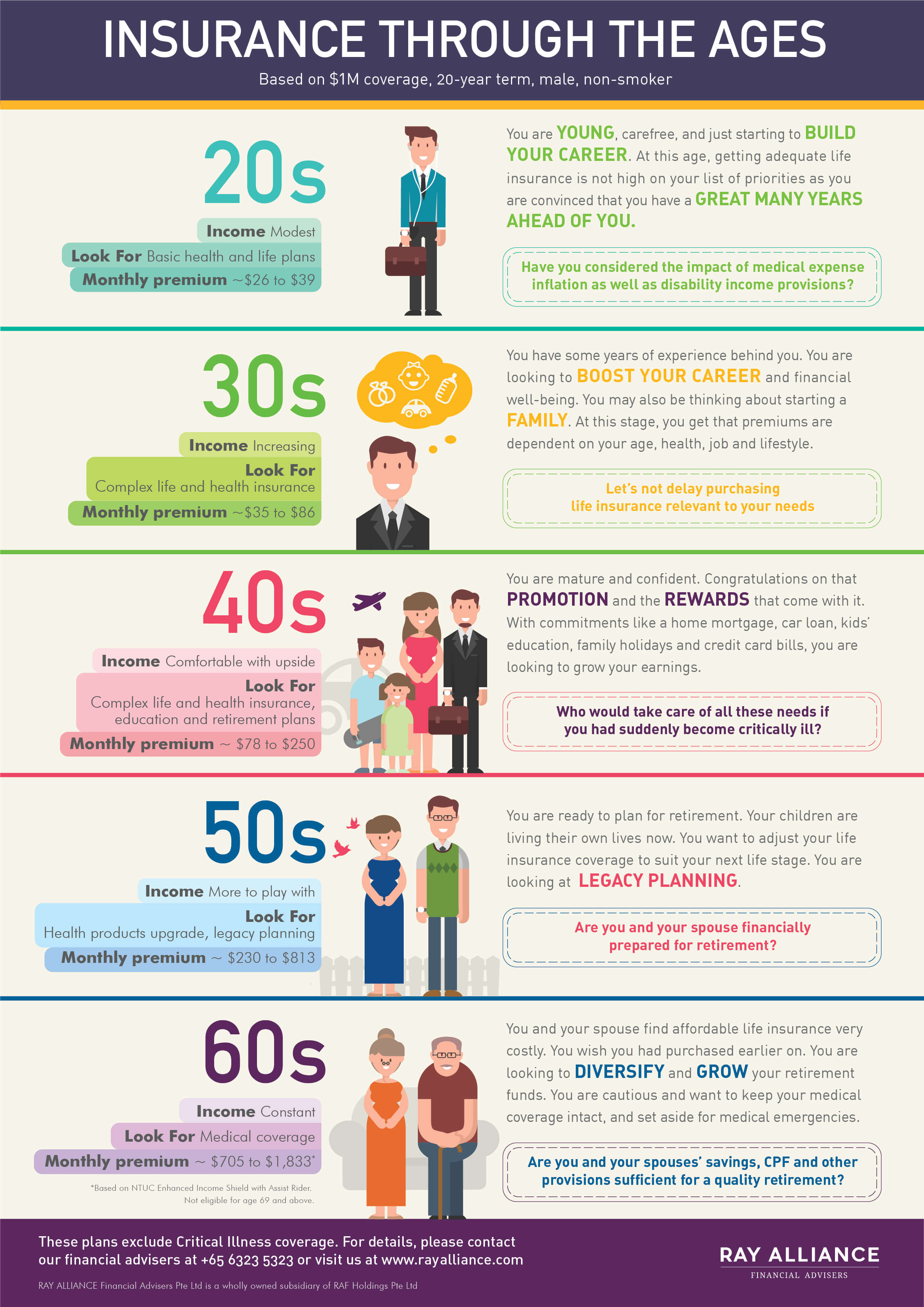

There are two groups of people who are most affected by this change; insurers and those in their 20s-30s. On paper, the insurers might seem to have gotten the longer end of the stick. But we think that young adults in their 20-30s could reap more benefits than most people think.

The “Lucky” Ones: Insurers

Just days after the insurers “appealed” to MOH to tweak IP riders, the government came out to announce that co-payment on IPs have been mandated. The chance of such a coincidental event happening is so low that we had to re-read the news a few times to make sure that we aren’t dreaming. With their wish coming true, it is arguable that some insurers have emerged as one of the “winners” with the new rule.

The “Unlucky” Ones: Those In Their 20-30s

The other group who are impacted by this change is the one that we are more worried about. And if you are in your 20s or 30s, this should be the part to pay most attention to.

Missed Opportunity To Buy Full Payment Rider IPs

As most of you are still in the early stage of your life and career, the thought of buying an IP might not have crossed your mind. As a result, you are now stuck in this limbo and having a dilemma about whether you should still buy an IP. You might feel sad, discouraged, or even frustrated that you didn’t buy one before the rule kicked in, but there are two things that we think you should be thankful for in this whole saga.

(P.S. If you had bought one with full payment rider after your financial adviser recommended it to you, you better thank your financial adviser and buy him or her a meal.)

2 Reasons Why You Should Be Happy About The Change

1. Enlightenment On IPs

Firstly, you got introduced to the concept of IP. If the government decided to keep things status quo, IPs wouldn’t be making headlines. You might continue to live your life without knowing the existence of IPs and not realize how useful an IP is. But thanks to the new change, almost every Singaporean has come to learn about IP and started researching on how IPs work.

2. IPs Are Likely To become Cheaper For You

Secondly, throwing aside the prejudice that you might have developed, we believe that the change is one that benefits you. Let us illustrate and back up our claim with numbers. We shall use John (an average 25-year-old) as an example.

If John decides to buy a full payment rider on Income’s Enhanced IncomeShield Preferred plan, his annual premium payable will be $683 (i.e. Main Plan at $255 with Plus Rider at $428). The rider portion of his premium is 67% more than his IP premium! But if he is now mandated to take a 10% co-payment rider instead, his annual premium payable is only $517 (i.e. Main Plan at $255 with Assist Rider at $262). This will help you save $27,158 in premiums over the next 50 years!

Some of you might ask, “What if the 10% co-payment costs more than $27,158 over the next 50 years?”. Yes, that is possible, but is it probable? To maintain IPs’ affordability, the government has mandated that the maximum annual co-payment amount not exceed $3,000. Unless you can chalk up $270,000 of hospital bills spread out evenly over 50 years, you are, in fact, likely to get a better deal with the co-payment rider.

Source: Income’s Enhanced IncomeShield Product Brochure

Planning In Advance To Get Ready For Good IP Deals

As insurers have to modify their IP plans to suit the new regulation, we foresee some insurers introducing good IP deals to the market. Instead of focusing on the new co-payment rule (READ: distraction), you should be thinking about how you can grab the best upcoming IP deals to fulfil your protection needs. So, why not engage a financial adviser today to help you make the right plans, in advance?