Financial Planning for “Singles”

11 Apr 2021

When it comes to financial planning, “single” doesn’t mean unattached. Rather, it means that you are the only person providing income for yourself. People who are unmarried, divorced, single parents, or widowed can all be considered single.

Today, the number of singles in Singapore is on the rise. Modernisation, and the rise in educational levels, are two of the main contributing factors. Some choose to remain unattached as this allows them to follow lifelong pursuits of a cause or passion.

However, there are some financial considerations for singles. Being single requires greater self-sufficiency. There may be no one to help when your finances run low or to see to your financial needs in your twilight years.

Having worked with many singles over the years, I’ve identified some priorities for singles to look into.

1. Having An Emergency Fund

Unlike a married couple with working children, singles may not have anyone to fall back on during an emergency. If you get injured and are unable to work, you may be forced to take up high-interest loans to pay your bills. This may result in long term debt issues.

That’s why it’s of utmost importance that you have an emergency fund.

If you’re an employee, this fund should cover six months of expenses. If you’re self-employed, extend the size of the fund to 12 months of your income.

Your funds must be quickly accessible. Don’t place them in products like fixed deposits, where you may face penalties for early withdrawal.

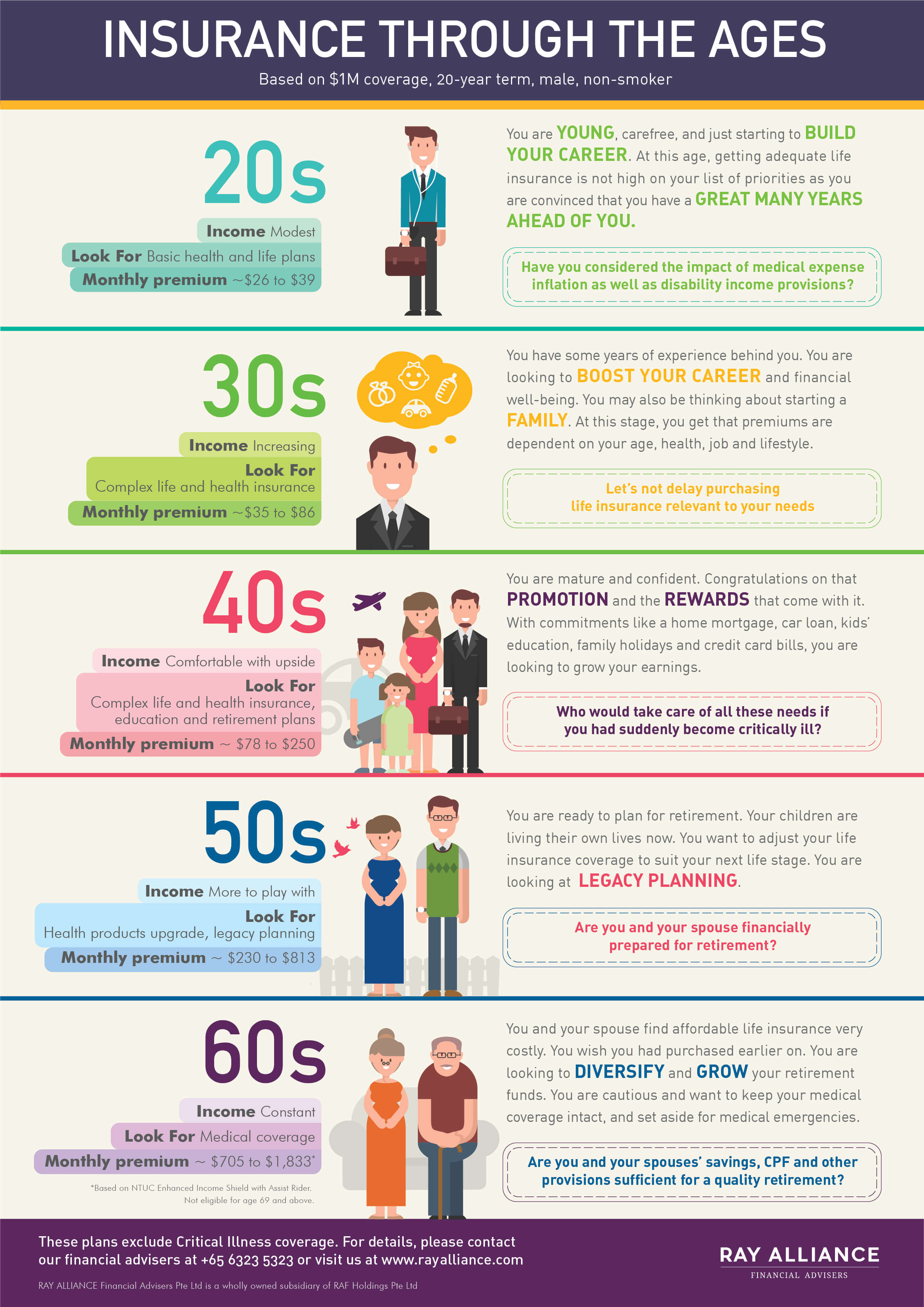

2. Paying Off Your Medical Bills

Medical bills are some of the highest costs you’ll face. If you’re not well covered, a single bout of illness or one bad accident can leave you in debt for years.

Singaporeans’ basic hospitalisation needs are taken care of by MediShield Life; but this only covers hospitalisation in Class B2 or Class C wards.

Consider enhancing this with an Integrated Shield Plan (IP). This gives you the option of healthcare in a Class A and B1 ward, in government of private hospitals.

You may also need additional health insurance cover as there’s a “deductible” portion to insurance claims. This is the fixed amount that you must bear each year for your hospitalisation. On top of that, there is also a 10% co-insurance, after the deductible, that you will need to pay as well.

The approved Integrated Shield Plans payouts will only kick in after you’ve paid the deductible and co-insurance. These can be covered by additional riders to the approved Integrated Shield Plans.

3. Critical Illness Coverage

Early detection of any illness can save your life. But early detection is meaningless, if you lack the money to pay for immediate medical intervention.

If you discover a critical illness in its advanced stages, you’ll probably need drastic lifestyle changes. You may need a stay-in helper if your mobility is impaired, or you may need to cover the cost of expensive medical equipment.

As such, singles must ensure that their critical illness payout covers their debt obligations over a prolonged period. The emergency fund is just a stopgap measure.

4. Having A Disability Income

Critical illnesses are not the only thing that could affect your lifestyle. You also have to consider the impact of accidents, which stop you from working. For example, if you sustain a back injury that lasts three to six months, and if that affects your work, the condition can cause a drastic drop in your income.

Disability income insurance can provide up to 75 percent of your (averaged out) monthly income. This type of insurance will pay a monthly amount as long as you are disabled up to your stipulated retirement age. Coupled with an emergency fund, the disability plan will help to provide for your monthly expenses while you are recovering.

5. Planning for Retirement – Making Your Money Work for You

Don’t think of retirement as a specific age like 62 or 65 years old. The main point to retirement is that when you want to stop working, or just want to work less, you’ll be able to do so.

Having a guaranteed income that pays for life is important. Consider how much you want to live on every month once you’re ready to stop working.

Your passive retirement income should account for your basic needs, like food and healthcare, and for lifestyle choices that are important to you such as travelling, building a stamp collection or golfing.

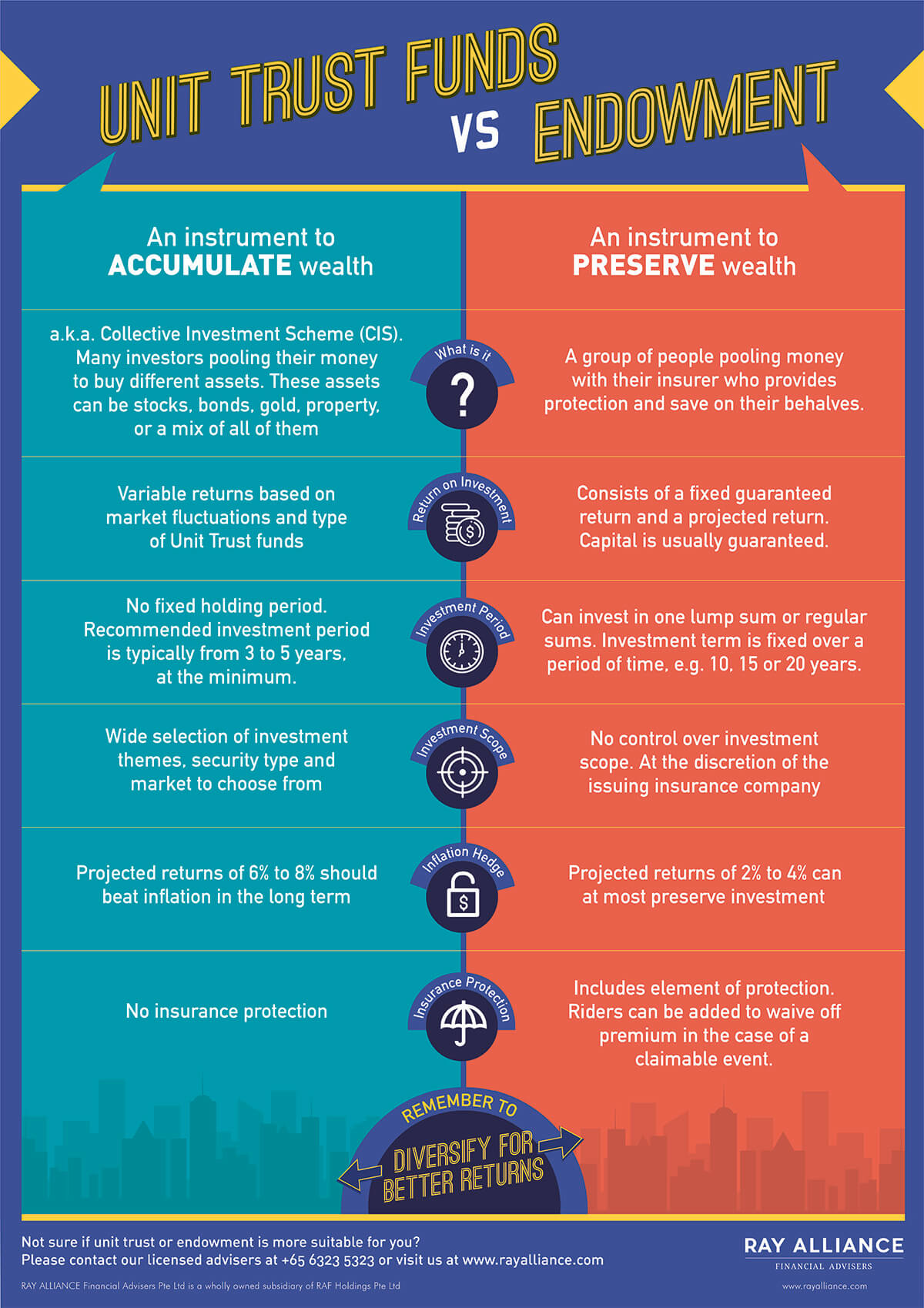

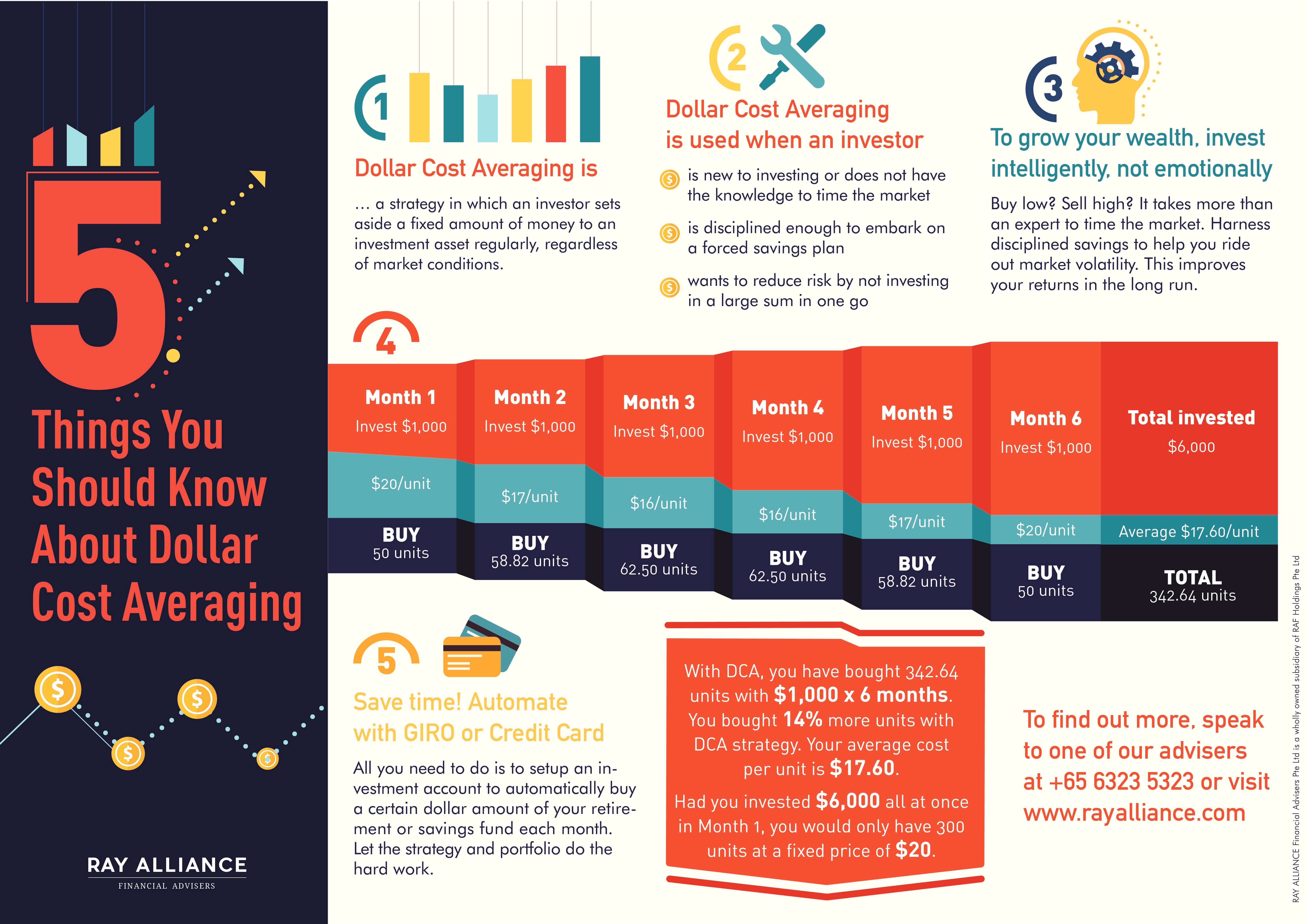

Start planning as early as possible. When you know your desired passive retirement income, you have clear financial goals. You can decide how to get there with a balanced and well-diversified portfolio.

6. Managing Your Estate When You Are Around and Not Around

Having financial independence is important, but there are times you may need to depend on others. If you become incapable of managing your funds, whom do you trust to make health and financial decisions on your behalf?

Wills, lasting power of attorney, and advanced medical directives are important in this regard.

If you’re single with young children, a will lets you appoint a guardian who can care for them. Your will can state your wishes regarding asset distribution, such as allowing your children to receive their whole inheritance only when they have reached financial maturity.

Lasting Power of Attorney (LPA) lets you appoint a third party, such as a close friend, to make decisions for you when you lack the capacity.

An advanced medical directive is a legal document pertaining to your medical treatment. This compels your doctor to discontinue treatment under certain circumstances. Money allocated for your treatment can go to charities and causes you care for, or to children or friends of your choice.

These are all important considerations for singles as you may not have a family member to speak for you in such situations.

Take the above steps to be a carefree single! Live well and be free of worries!

Connect with me on LinkedIn or visit www.rayalliance.com to learn more about financial planning.

About Esther Lee

Esther Lee has spent three decades as a successful financial adviser. She comes from a difficult background, in which she had to deal with both parents’ illnesses; Esther now uses her expertise to help others in difficult financial situations.