The C Word

12 Apr 2021

The C-Word And The Associated Cost Most People Fail To Consider

Mention cancer (the C-Word) and most people shudder in fear. This is not alarming, especially when cancer IS the top killer in Singapore.

Numbers Show An Increasing Cancer Risk Among Singaporeans

According to statistics released by Ministry of Health, cancer is the top principal cause of death from 2014 to 2016. Cancer accounts for close to 30% of all deaths in Singapore. And if that doesn’t scare you, brace yourself. According to a report by Straits Times, cancer diagnosis for breast cancer (women) and prostate cancer (men) has been rising sharply in Singapore.

Over the past 40 years, the diagnosis of breast cancer here has more than doubled – from 25 to 65 per 100,000 women. Over the same period, prostate cancer has gone up fivefold – from six to 30 per 100,000 men. In addition, for women, breast cancer is not just the most common cancer (33% of cancer in women), it is also the top killer.

The Arduous Battle Against Cancer

Battling cancer is draining in all aspects: Physically, mentally and even financially. When battling cancer, doctors will always tell you that your state of mind is very critical in helping you recuperate. But how can you keep a positive state of mind when you are facing financial difficulties? Most people think that a comprehensive health and surgical (H&S) insurance plan is enough to settle most of your cancer bills. But is it really enough?

Alternative Costs To Consider In Fighting Against Cancer

There are a few areas other than direct medical costs that need to be considered in the battle against cancer.

- Income Replacement

The fight against cancer is not just draining on finances, but also exhausting physically and mentally.

US Study On Cancer Patients And Its Impact On Employability

A US study by Reuters found that “58% of the patients in the study reported some changes in employment due to illness, whether they scaled back hours or stopped working entirely”. The reasons cited include fatigue, drowsiness, severe pain and even memory loss. This indicates that most cancer patients would wish to stop working and focus on recuperation when they are battling against cancer. The study also found that some cancer patients continue to work because they have to maintain their income and/or health care insurance coverage. In other words, they have no choice but to continue working.

It is evident that a H&S plan that only provides direct coverage of medical costs would prove inadequate. Not only will you require a comprehensive H&S plan, you will also need a replacement income streams through other protection plans so as to enable you to focus on recuperation.

- Alternative Treatments

In straightforward cases or earlier stage diagnosis, the medical procedure for cure against cancer is simple: Remove the tumour or cancerous cells and go back to your normal life. But what happens if it is not such a straightforward case, e.g. advanced stage diagnosis?

Alternative Treatments: Complementary And Alternative Medicine (CAM)

When someone meets an unfortunate case like that, he/she has the tendency to seek complementary and alternative medicine (CAM) as long as it gives them a glimmer of hope to get well. For example, cancer patients often explore alternatives such as traditional Chinese medicine (TCM), homeopathy or products like herbs and vitamins to aid their fight against cancer. There is emerging evidence that some kind of complementary therapy can help patients cope with the side effects of cancer treatment. For instance, acupuncture has shown to be effective in the treatment of nausea and vomiting due to chemotherapy in trials.

According to a study by National University Cancer Institute Singapore started in 2014 that surveyed cancer patients in advanced stages, 20% of them seek oral CAM while on chemotherapy. They were actively seeking alternatives to give them a better chance in their fight against cancer.

Alternative Treatments Come At A Hefty Cost

Yet, the problem with alternative treatment comes down to cost. It is imperative to note that some CAM comes with a hefty price tag. As you might have guessed, most H&S plans do not pay for your CAM bills. You will have to foot it yourself. This is where protection plans that provide lump sum payout will help to defray the costs of CAM.

- Palliative Care

What happens when an oncologist presents the dreaded news that it is medically unviable to treat you? What happens when he/she tells you that cancer treatments will prove more toxic and deadly than cancer itself? Most people are optimistic when it comes to battling cancer, but they fail to recognise that there might be a situation where there are no medical solutions for the condition. In such cases, palliative care becomes an important part of the ‘treatment’.

Growing Demand For Palliative Care

Palliative care is care given to improve the quality of life of patients who have a serious or life-threatening disease. At the late stage of their illness, cancer patients are often aiming for pain control and symptom relief, which hospice palliative care aims to address. Palliative care is slowly gaining receptivity in Singapore. According to a Death Attitudes Survey by Lien Foundation, 76% of Singaporeans are open to receiving hospice palliative care for themselves and 80% are open to getting hospice palliative care for their loved ones.

What About The Cost Of Palliative Care?

However, there are significant barriers to receiving hospice palliative care. One of the major barriers would be cost. 43% of respondents to the Death Attitudes Survey by Lien Foundation cited high costs as their reason for not considering palliative care. 64% of all surveyed also think that hospice palliative care is expensive.

Since H&S plans covers the direct medical costs of cancer treatments, palliative care is not included in the scope of H&S plans. Thus, cancer patients find themselves unable to afford palliative care despite having a good H&S plan. No wonder there is often the saying among Singaporeans, “You rather die than fall sick in Singapore”.

Ammo To Fight The C-Word

If you are looking for the right ammo to fight the C-word, here are a few plans that will help you:

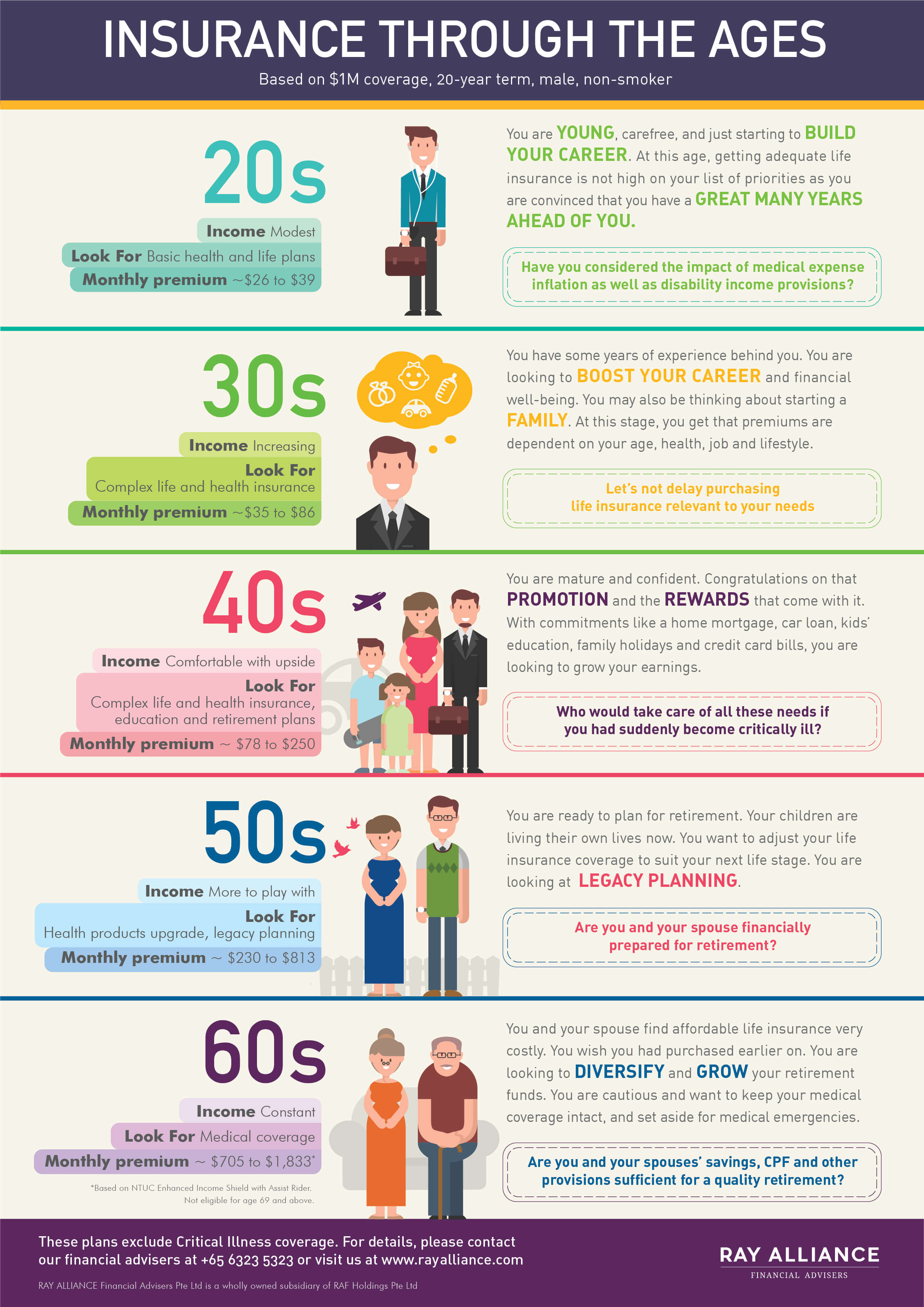

- Hospital And Surgical (H&S) Plans

Hospital and surgical (H&S) plans include Integrated Shield plans that enhance existing MediShield Life and Employee Benefits. H&S plans are there to help you foot the bill for hospital and surgical expenses and outpatient cancer treatments for the likes of Chemotherapy, Immunotherapy, Radiotherapy and Brachytherapy (or as I would call them Cancer Exterminators).

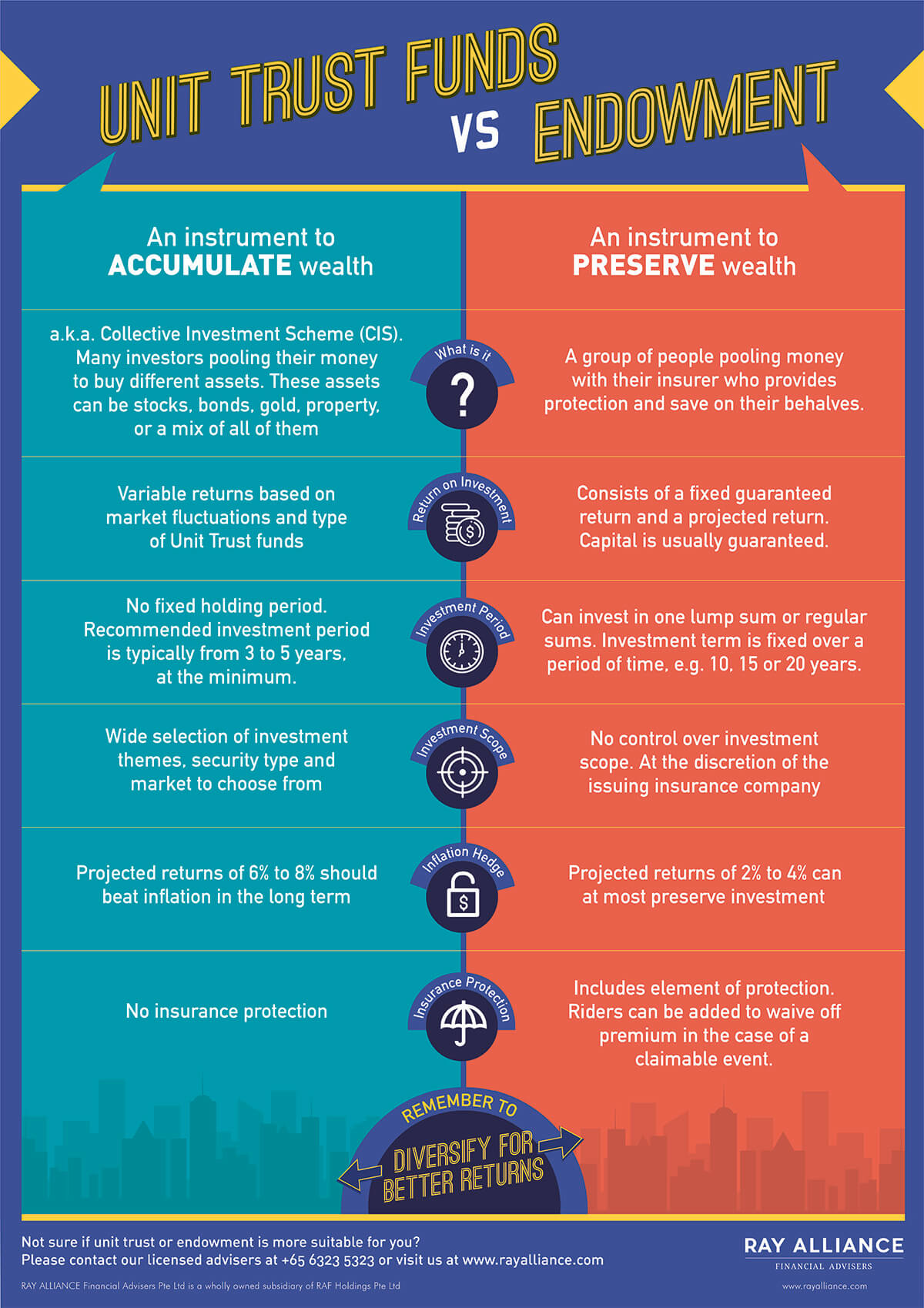

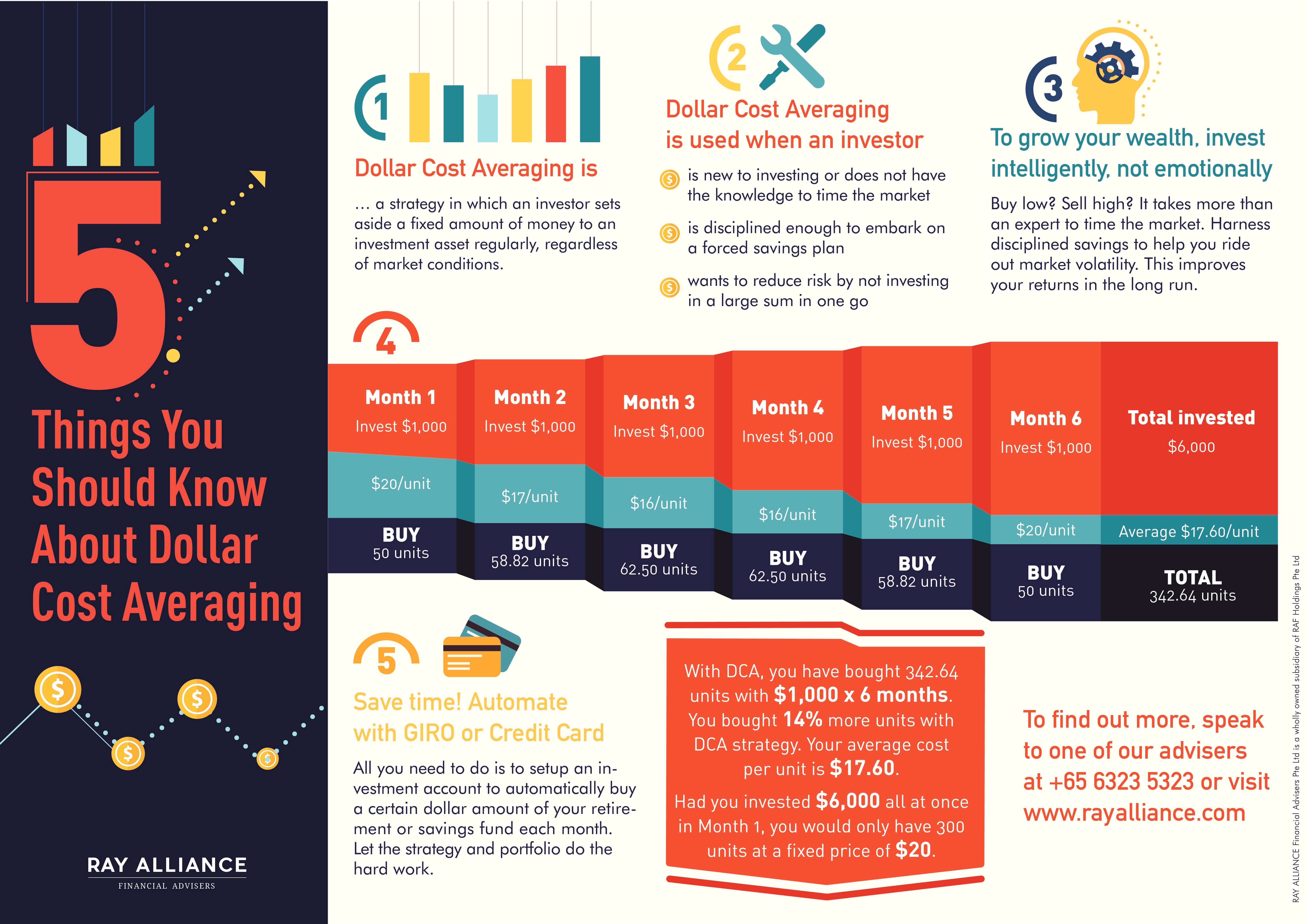

- Protection Plans

Protection plans include whole life, term, investment linked policies, standalone critical illness and disability income. These plans come with riders that will allow you to receive lump sum payment for diagnosis of the C-Word. It can be detection early, intermediate and advanced stages of Critical Illnesses (CI) depending on the riders attached. The idea of such protection plan is to help you defray living expenses while fighting the battle against the C-Word. It can also help to support your dependents.

- Standalone Cancer Plans

Standalone cancer plans offer the opportunity for people with pre-existing conditions to get covered for cancer. Without standalone cancer plans, these people would face rejection for their application due to medical conditions that are not related to cancer.

Building The Right Plan Against Cancer

The truth is, Singaporeans are becoming more aware of the growing dangers of cancer. More people are recognising that cancer is not something distant, having heard cancer stories from close friends, relatives or even read about unfortunate stories on social media. There is also growing awareness of the importance of financial planning and insurance and how these will help in the unfortunate diagnosis of the C-Word.

Find out how you can build the right plan against the C-Word today with the right mix of H&S, protection plan and/or standalone cancer plans. It is never too late to start protecting you and your loved ones by signing up for a consultation with one of our consultants.