Stranded...

06 Apr 2022

You have been stranded here. And you have been dreaming of rescue every cold black night since then. You have had only one thought, one goal - escape. Escape and one day return home. The only challenge is that your way out is via the sea.

Running away from your captors, you reach the pier. Now in front of you, there are three different boats that can aide your escape:

- Boat A: A small boat with a large sail

- Boat B: A medium size boat with a medium size sail

- Boat C: A large boat with a small sail

Boat A is small boat with a large sail.

You have a chance to escape the island in the shortest amount of time with the least amount of effort spent in rowing, if you catch the wind blowing in the right direction. However, it lacks the stability in face of the forces of nature. It might even capsize when the wind and acts against you!

Boat C is large boat with a tiny sail.

Good news for you though, because it is so huge and stable, there is almost little to no chance of the boat capsizing. Despite the stability, it requires a lot of effort from you to row to propel the boat forward. And if the wind is against you, you might be pushed back.

Boat B is a medium size boat with a medium size sail.

Right in the middle lies a medium size boat with a medium size sail. This boat allows you to take a break when the wind is blowing in the right direction. When the wind decides to act against you, the boat is still stable enough to prevent it from capsizing. All that is needed is for you use some energy to row the boat consistently.

What is your choice?

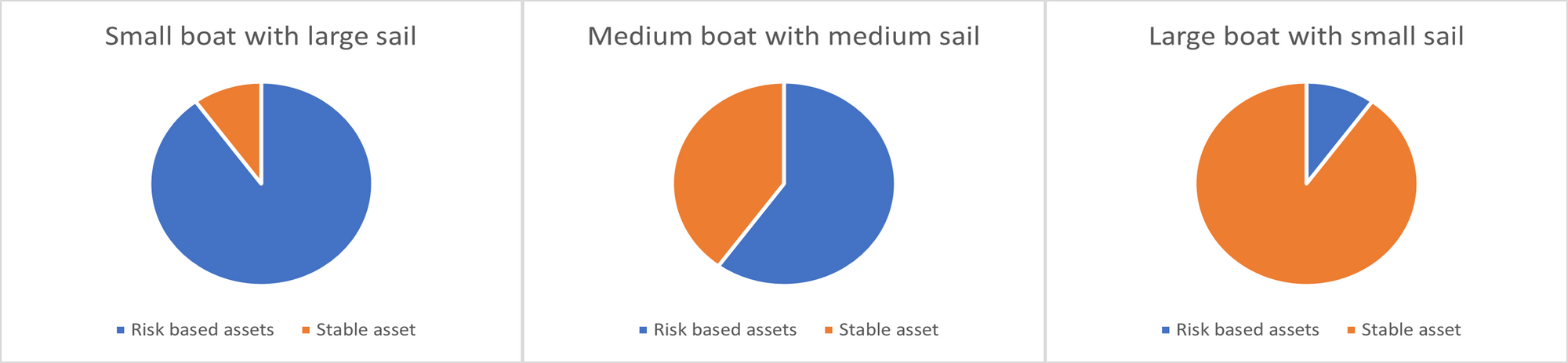

There is a financial planning lesson that lies in the narrative above – risk management in planning for retirement. The escape from the island is our attempt to escape the rat race, with the boat and sail being our choice of retirement planning tools and, the wind representing the performance of the investment market. If I’m able to translate the boat and sail into retirement planning actions, here is probably how it will look like.

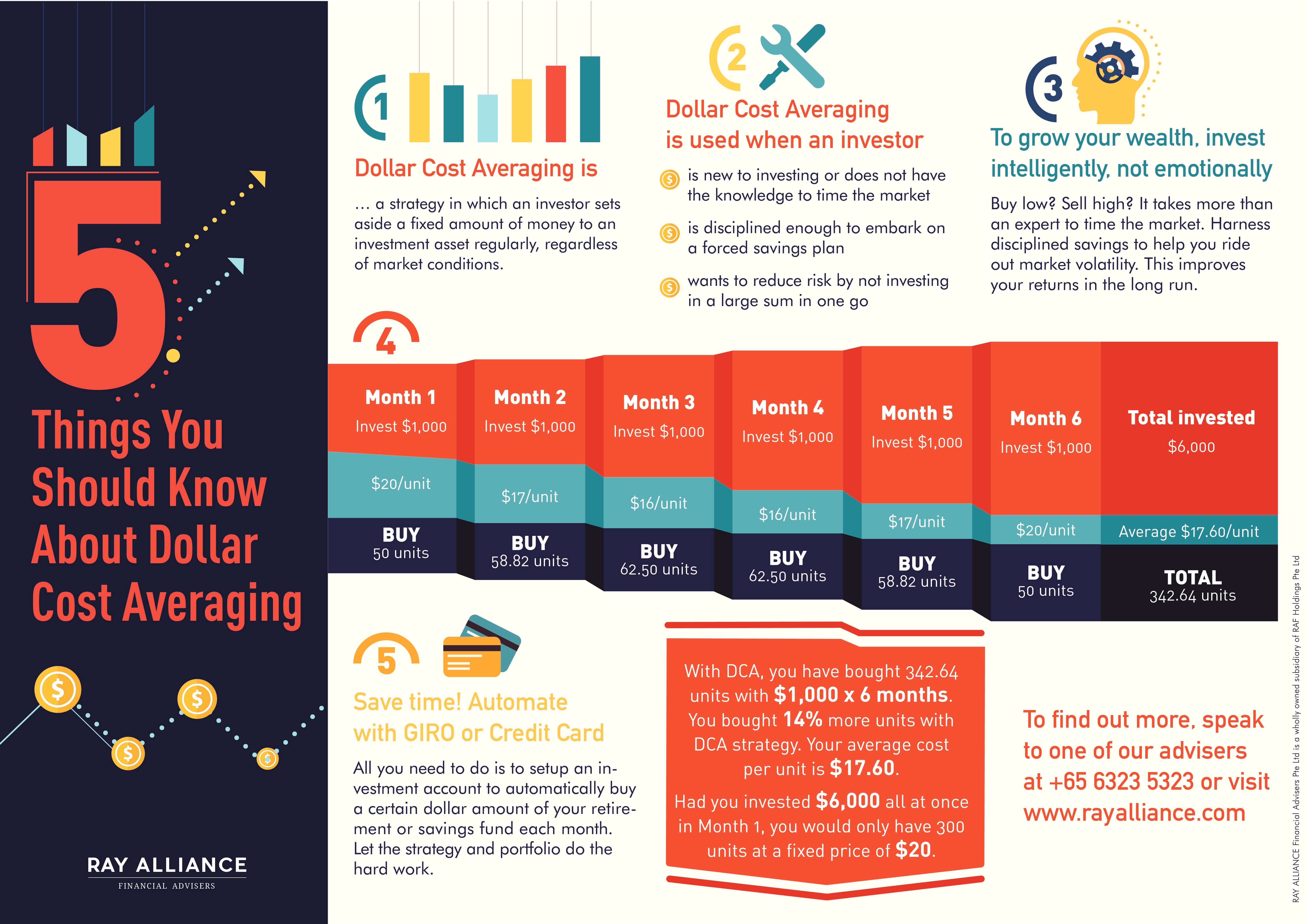

In choosing the small boat with large sail, you could possibly reach escape the rat race in the shortest time, however there will be much higher risk involved. Rewind to 2008, one who invested aggressively into S&P 500 for retirement will be left in a limbo. The index crashed by more than 40% and took more than 4 years before it recovered. Or the recent cryptocurrency crash at the turn of the new year that erased more than $1 trillion in market value. The most important question though, how many people can tolerate the huge loss and hold on to their position?

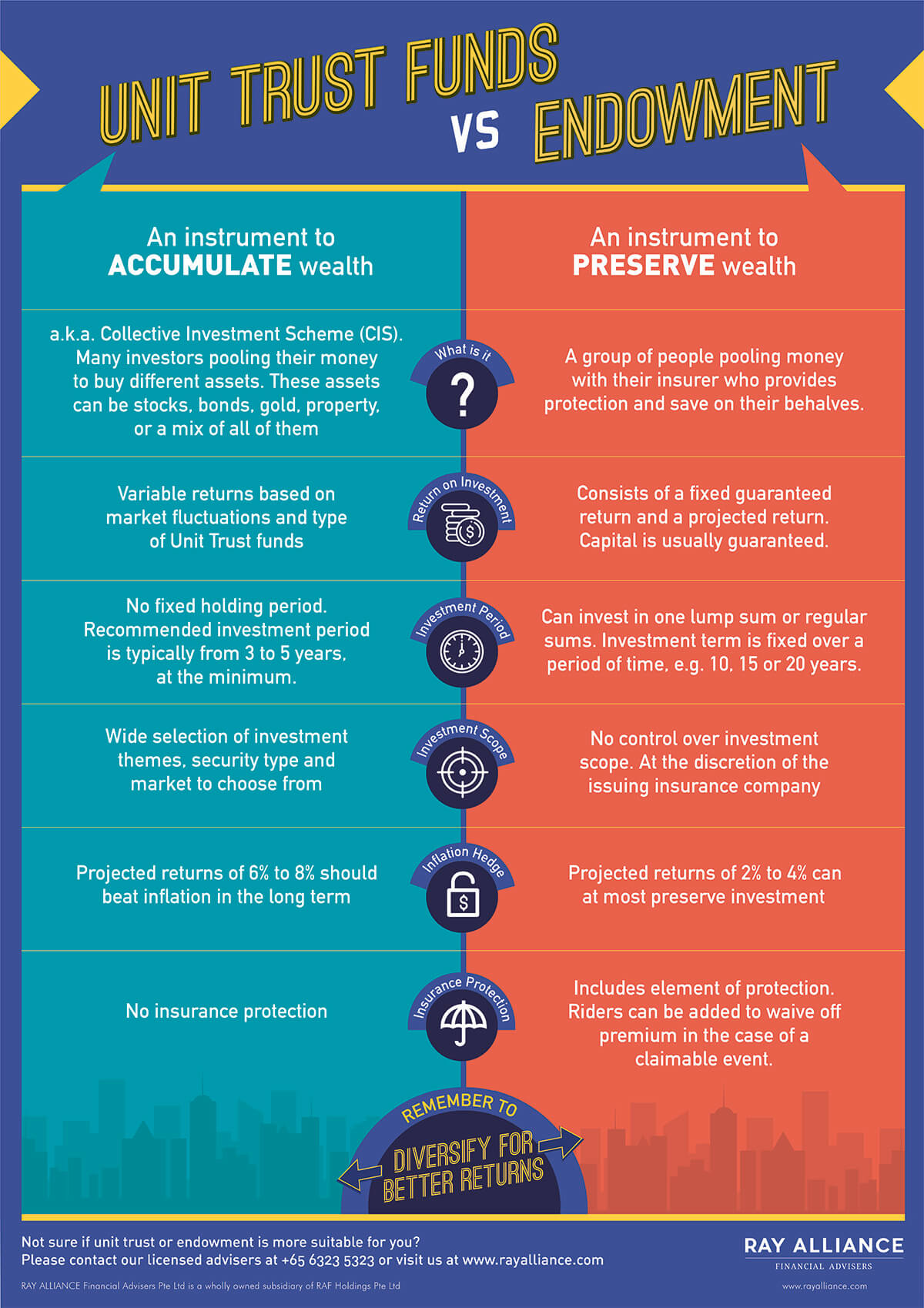

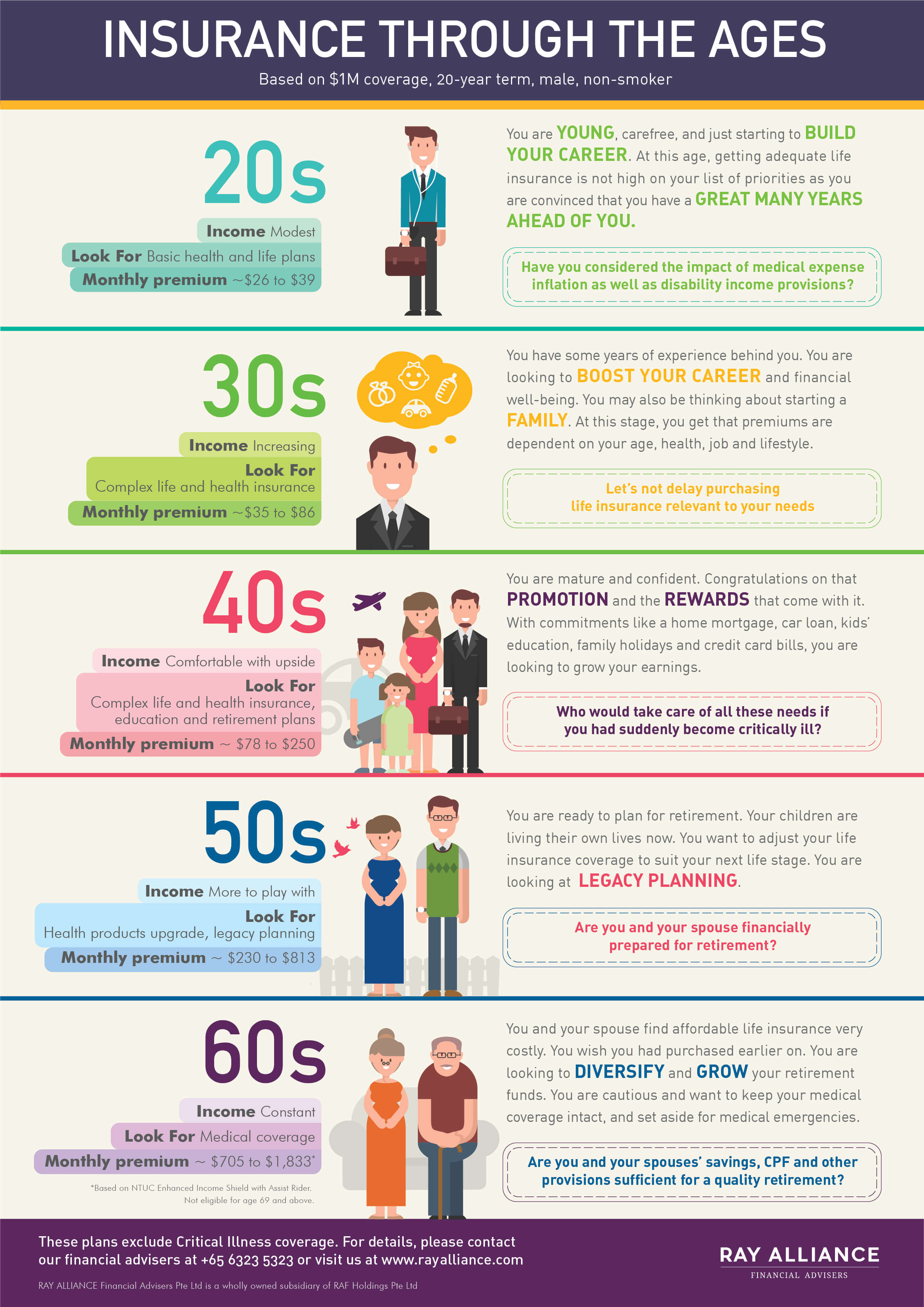

Stable assets such as cash, fixed deposit, national pension scheme, insurance based endowment or retirement plans typically comes with a guaranteed and non-guaranteed component. The risk involved is relatively lower, or even risk free with capital guarantee. But it will accumulate much slower, typically around 0.5% to 3%. Hence, to achieve the same goal, you will need to set aside a lot more per month.

We know that Boat B in this narrative might be your best bet to escape this island.

Likewise for financial planning, knowing the type of boat you are on will help you better understand if you are moving at your desired speed. At the same time, you can evaluate the probability of the boat capsizing. At certain time, you might be tempted to risk it all without considering the risk, or at the other end of the spectrum, simply take no risk at all and stash all your savings in a bank deposit account.

Hence, there is a need to review your goals regularly to ensure that you are on track to achieve them and to ensure that you are using the appropriate tools in your passage to escape the rat race.