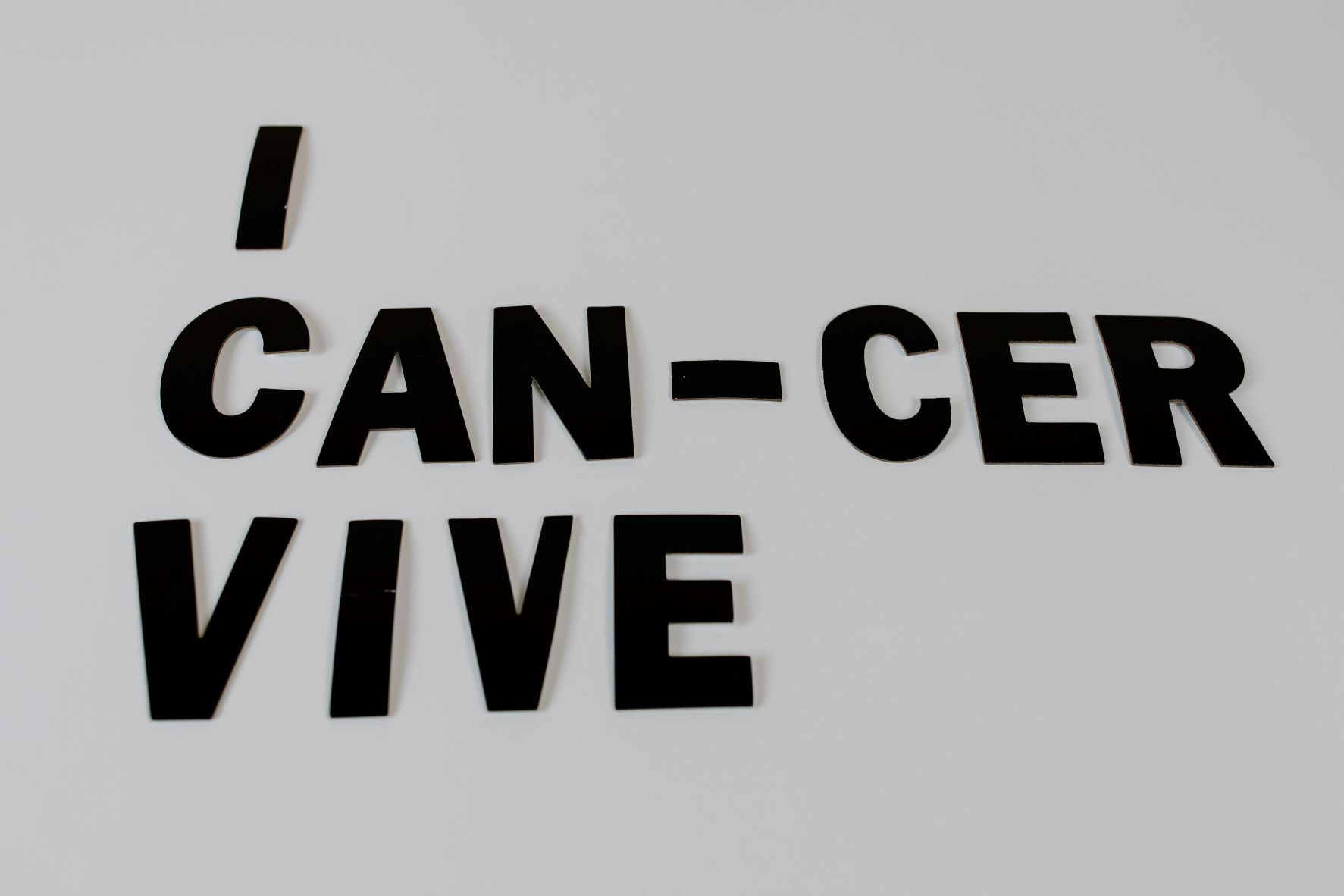

The Dangerous CI Protection Gap And How To Address It

13 Apr 2021

In any insurance situation, you want to ensure that you are 100% covered for any economically damaging event. You do not want to be in the situation where you are covered for less (or even not covered) by insurance, aka a protection gap. Unfortunately, Life Insurance Association’s (LIA) latest Protection Gap Study found that many Singaporeans have a protection gap in our critical illness (CI) coverage.

Singaporeans Aren’t Well-Protected Against CI

Based on LIA’s Protection Gap Study, an average Singapore only has around S$60,000 worth of CI coverage. But in reality, Singaporeans need an average of S$300,000 CI coverage in order to be financially well-protected if one is diagnosed with CI. This means that Singaporeans are only 20% covered for CI, which translates to protection that is only enough to cover your surgical and hospital bills! But what about the cost of your after-treatment recuperation? And what about your loss of income during the period of hospitalisation and after-treatment recuperation?

What Led To The Dangerous CI Protection Gap?

There are various reasons why many of us have fallen into the dangerous situation of having a CI protection gap. The lack of awareness of CI protection and the “invincible mentality” are the two main ones that have led to the resulting CI protection gap. Most of us think that we are still young and relatively healthy. So, why should we be bothered about CI insurance? “Let’s just wait and see” is the common mentality that most of us adopt.

Why Is There A Pressing Need To Plug The Dangerous CI Protection Gap?

However, as medical treatment advances, our average life expectancy has been increasing. According to World Health Organisation, third in the world in terms of life expectancy. An average Singaporean would live till the age of 83.1 years. The unfortunate thing is that some might be plagued with CI as we age. Thus, plugging the CI protection gap is a pressing and immediate need that we need to address.

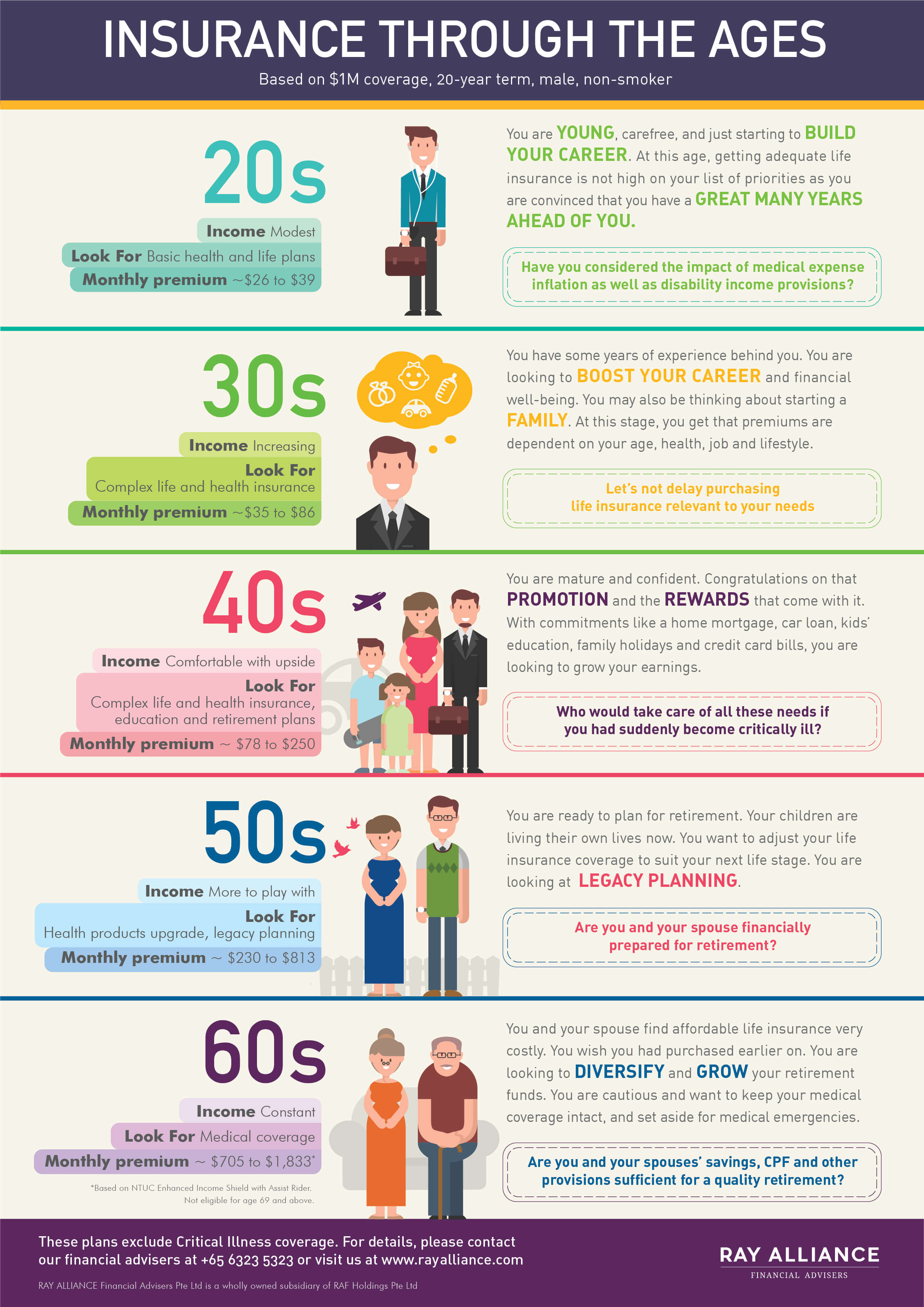

Premiums Become Exponentially Expensive As You Age

If you understand how insurance works, then you will know that CI insurance premiums increase with age because of the increasing risk of insuring your life against CI. In addition, the likelihood of CI occurring increases exponentially with age. This in turn means that your CI insurance will be exponentially expensive the later you leave the purchase decision.

Pre-Existing Conditions Can Lead To Un-Insurability

The “Let’s just wait and see” mentality also leads to the problem of development of pre-existing conditions. This could lead to the risk of being classified as a ‘substandard life’, which means that you will have to pay an additional premium top-up on top of the standard CI insurance premium. The other consequence of the “Let’s just wait and see” mentality is the potential problem of un-insurability. The pre-existing condition might be too risky for any insurer to take on that they decide to exclude you from any CI insurance.

Since we know that we need the essential CI insurance, why not get it early and get it cheap to protect ourselves and our loved ones?

Who Are Affected By The CI Gap And How To Address It?

There are two main problems that are highlighted by the study: Under-protection and lack of protection.

1. The 30s-40s and Under-Protected

The first problem of under-protection belongs to two groups of Singaporeans:

- Those who only have term insurance coverage (without CI)

- Those who have bought CI coverage but didn’t get the right amount of CI coverage

As a general rule of thumb, your CI coverage should be five times your future income, i.e. your current annual income plus some forecasted increment you expect in the next five years. If you fall below this guideline, you are likely to be in the under-protected category.

How To Address It?

Simply click on this link to get connected and get your financial plan analysed to stem out any protection gap in your financial plan today.

2. The 20-30s And Unprotected (Without CI And Term Insurance)

If you have neither a CI nor term insurance in your financial portfolio, then you fall into this category, i.e. ‘The Unprotected’. For those of you in your 20s, you might also fall into this category as you are still in the early stage of discovering the importance of insurance.

As ‘The Unprotected’ group, you face much higher risks than those who are under-protected. However, there is something to rejoice about. The absence of any insurance protection allows you to get both CI and term insurance coverage at a lower cost than the under-protected.

How To Address It?

Most term insurance comes with the option to complement your base plan with a CI rider. So, if you realize that you fall into the category of ‘The Unprotected’, you can get your term and CI insurance together for a much lower fee thanks to the CI rider option. It means that you can get a larger sum assured amount at a lower cost. You also don’t have to pay your insurance agent commission twice!

Find out which are the best term insurance plans (with CI rider) that you can get in the market today using our insurance comparison tool.