Welcoming 2023

20 Jan 2023Happy New Year!

(We’ve got some bad news that you really need to hear)

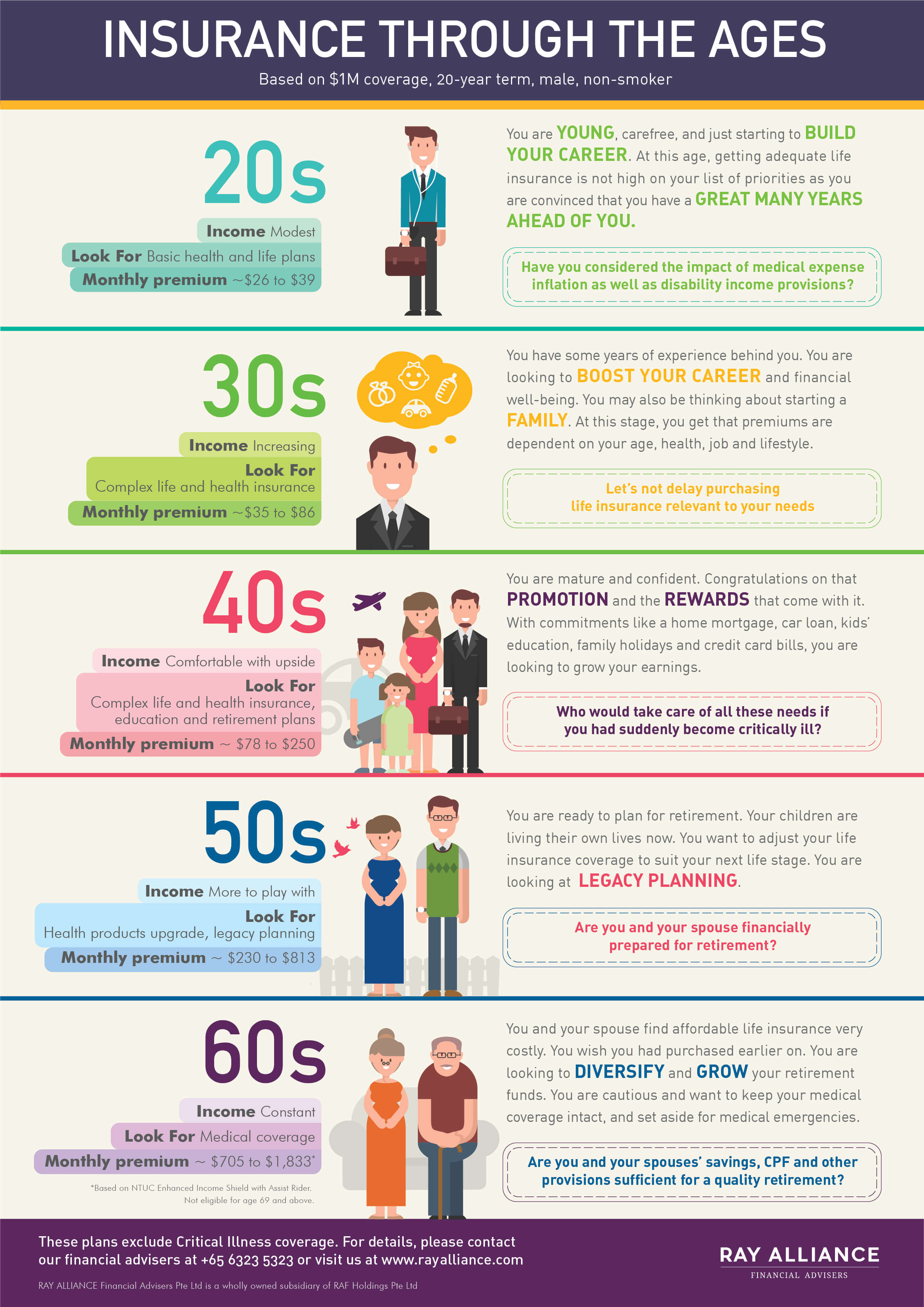

It’s the New Year, we know - but we’d be remiss if you didn’t tell you as candidly as we can: The economic outlook for 2023 isn’t great. And all this volatility and uncertainty means that your finances and financial plans will probably be poorly affected.

“Analysts forecast global growth for the new year to languish at 1.6% - half of 2022’s 3.2% growth,” says Raymond Ng, Managing Director of Ray Alliance Financial Advisers. “Geo-political upheavals, rising inflation, and the disquiet Covid pandemic that just won’t go away completely - all this points to a difficult 2023 that’ll be hard on everyone’s bank accounts and balance sheets.”

It’s a disconcerting outlook. Especially for an individual like yourself, trying to balance your investment goals and financial responsibilities. But beyond that constant state of worrying, it is really much more important to be aware, and recognise how your money can be optimised in the face of an unstable and slowing market.

To understand the concerns of their clients, Ray Alliance Financial Advisers conducted a recent survey of over 120 invested individuals. The results were predictably typical - survey respondents cited mortgage loans and short-term investment opportunities as top priorities going into 2023. But there were surprises too: one of which is a rather far-sighted focus on financial literacy for their children.

This is the lucid headspace of anyone who cares about the Now as much as they do about the Next. Rising interest rates are an immediate assault on all the loans you maintain, of which your mortgage most likely forms the lion’s chunk. As a counter to this bloating expense, you’d do well to consider short-term investment instruments that might benefit from the lethargic market - whether with cash or your CPF monies. And of course, all of this coherent planning to optimise the present circumstances leads to a bigger picture of financial security for you… and your children.

With the insights gleaned from the Ray Alliance Financial Advisers client survey, we’ve put together a quick list of financial considerations for anyone trying to navigate 2023, starting with…

#1 What should I do about my mortgage loan?

“Rising mortgage rates are a given and will continue to be in a high-interest, inflationary environment,” confirms Kang Beng Hui, Senior Partner at Ray Alliance Financial Advisers. “There’s not much you can do about it, but you also shouldn’t do absolutely nothing. Be proactive, understand your mortgage options, optimise your loan conditions, prepare to be nimble… and then focus on getting your gains from elsewhere.”

Your mortgage loan might cause you discomfort in 2023, but you really need to do this: Survey your options with an understanding of both your financial circumstances and the market to make the most optimised loan decisions. It might be about switching loan providers or loan products, or it might even make more sense to pay off some or all of it in cash. After you’ve made the most ideal decision given the intel available, the next step is to stay nimble, but really just forget about it - and focus on the other areas of investment that could be advantageous in a rising interest rate environment.

Talk to your Financial Adviser for a better idea about your options. Ray Alliance offers mortgage loan product advice and recommendations across a spectrum of loan providers. Beyond that, an in-depth understanding of your financial goals and commitments by your Adviser would make your entire loan, savings and investment planning more holistic and meaningful.

#2 Should I do more with my CPF money?

While lender and borrower interest rates have been on the up and up last year, CPF interest rates have stayed constant. The steadfast CPF interest rate that was a boon when bank rates were barrelling the bottom now looks like a poor cousin as an investment and growth tool.

The question is: Is this a good time to look into investing your CPF funds for potentially higher-than-interest-rate returns? The short answer is: A very strong Maybe.

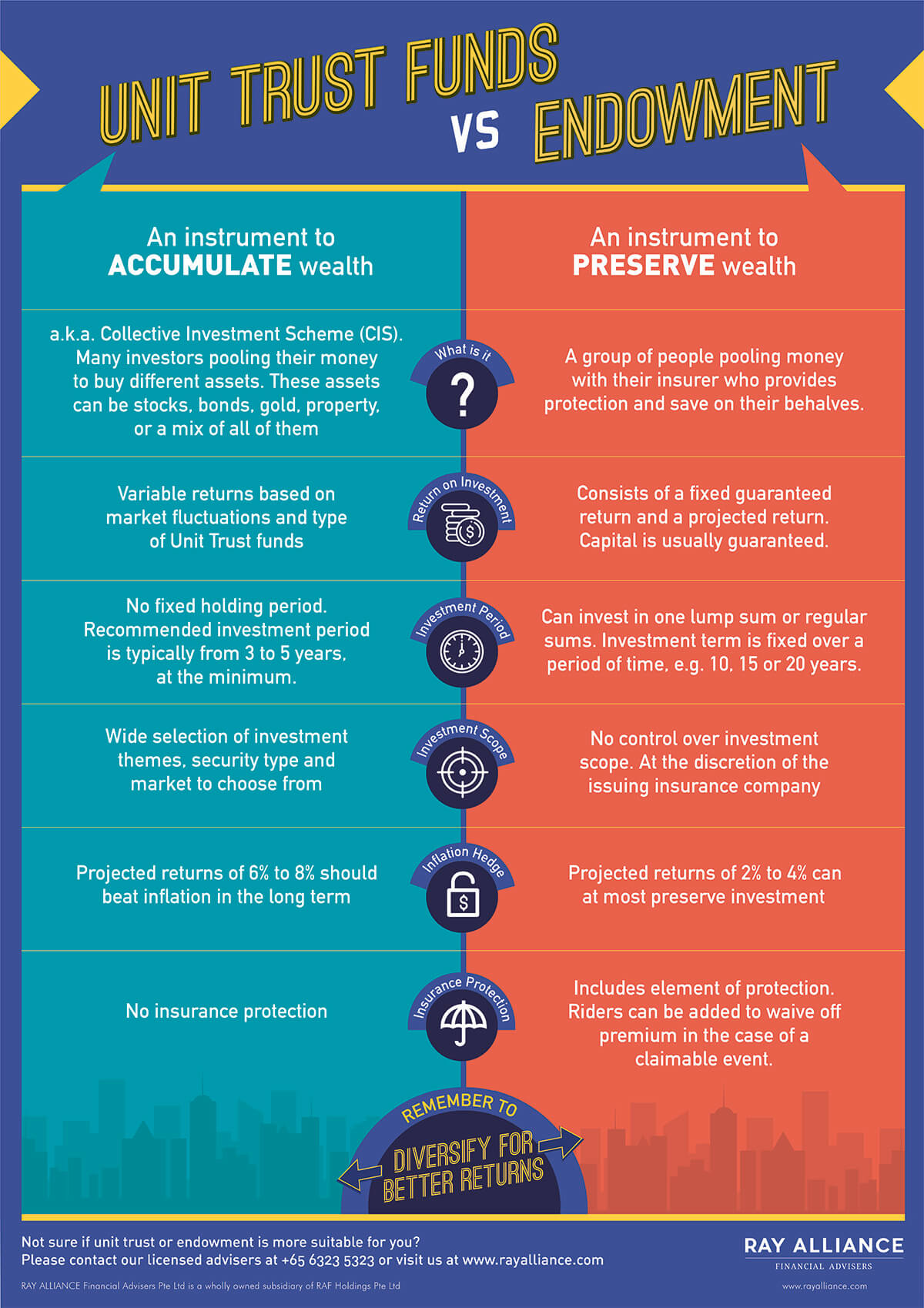

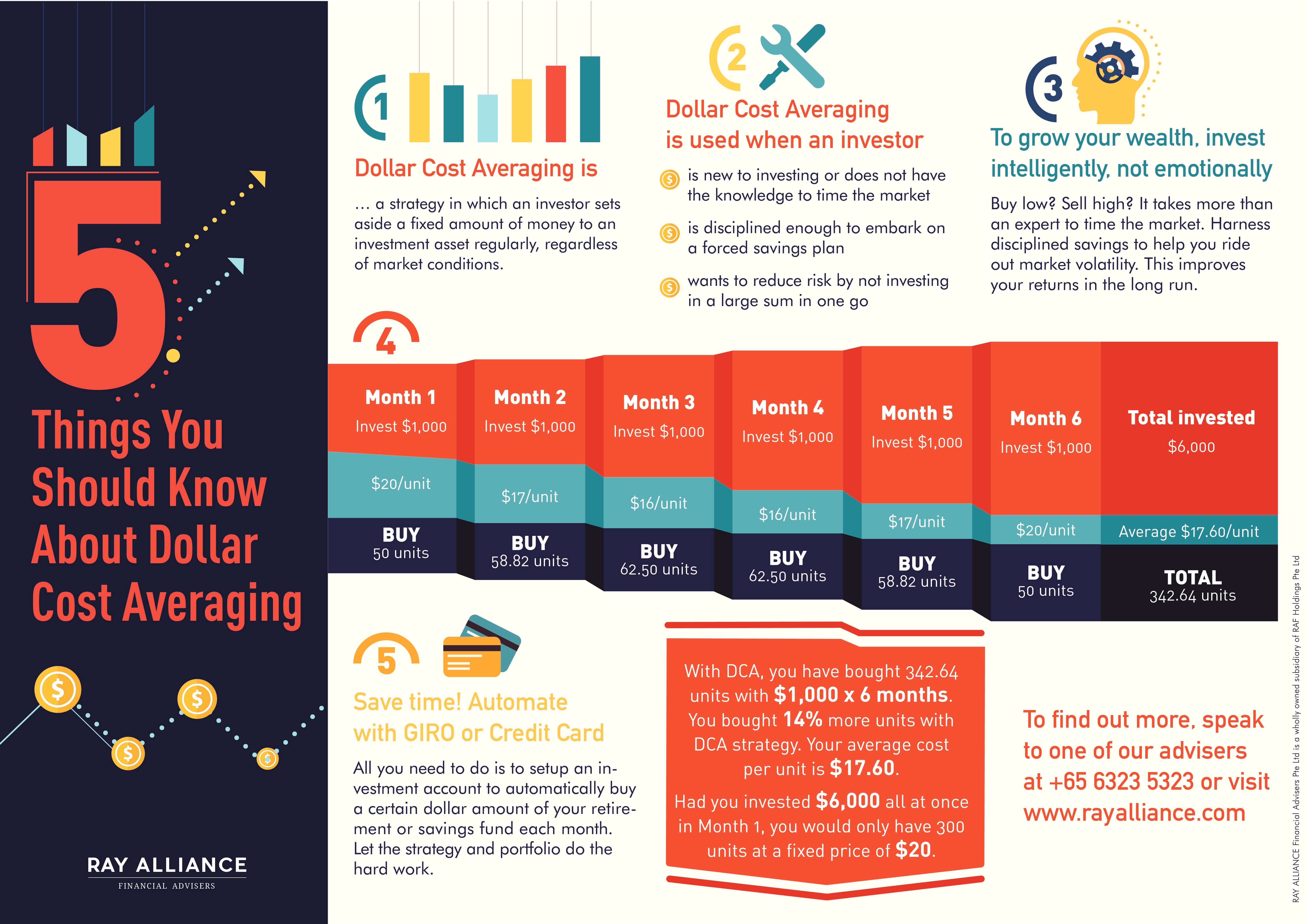

Every individual’s circumstances and investment comfort zone is different. But something that all growth-seekers should share is a willingness to understand and explore the options available, especially when an impending downturn forces us to optimise the potential return of every dollar we put out there. CPF has liberalised the investment options available over the years and there are now various possibilities for different goals and risk inclinations.

But Raymond cautions: “Even though you’re investing your CPF funds, the same rules of smart investing apply. Invest what you don’t need in the mid-term; understand what and where you’re putting your money into; and always maintain a diversified portfolio that is aligned with your risk appetite.”

If you find regulatory requirements surrounding what you can do with your CPF to be daunting, you can discover the best suited options for you together with your Ray Alliance Financial Adviser. He or she will take into account your goals and commitments, and map them onto CPF-approved financial instruments. The Ray Alliance customer-priority focus also means that if it so happens that your CPF funds are best placed to stay put, you can count on them to advise you as much.

#3 How should I invest my money - if at all?

Fixed deposit accounts, government and corporate bonds, and principle-guaranteed instruments have come to the fore in a volatile market. Boosted interest rates also mean that what was before, a low-risk-low-return vehicle (like Fixed Deposits) have suddenly become a very palatable place to put your money.

“The burgeoning of safe investment options available can also mean more confusion. But there is definitely a good variety of products that will cater to just about every need, across a spectrum of risk appetites,” says Beng Hui. “And a really meaningful financial plan wouldn’t immediately exclude the higher-risk, higher-yield products - a good Financial Advisor would be able to plug in different elements for a balanced and reasonably secure portfolio.”

At the risk of sounding like a broken record, it still all harks back to the basics of sound investing: understand your investment horizon, research the products you’re buying (even if you’re buying through an established advisory or platform like Ray Alliance), and always use money that you don’t need in the short- to mid-term.

#4 What should I teach my kids about money?

While grappling with real-world money issues that affect you right now, it’s also important to think about what this VUCA world (volatile, uncertain, complex and ambiguous) will mean for our children when they’re grown up and have to contend with these issues and then some. Financial literacy for children is one area that hasn’t been fully developed into the mainstream, and that is a real pity.

“[Financial literacy] is the new spelling,” declares Phillip Ong, Director at Ray Alliance Financial Advisers. “Our children learn the ABCs so that they can read and write - language skills that are important in our modern lives. And financial literacy - money skills for life - ought to be right up there with learning the alphabet. It’s really that important for our modern lives.”

There are the obvious basics when teaching children about money: The value of money; the importance of budgeting, of saving, of investing; and even the tricky concept of debt (there’s such a thing as good debt!). And finance has been shored along so quickly by technology that the topics our kids need to understand are fast changing. If you’re struggling with concepts like blockchain and ESG now, think of how much more complex it will be for them when all of it hits the mainstream. Start learning now, and start teaching them pronto. Their financial security will thank you later.